|

Today's Opinions, Tomorrow's Reality

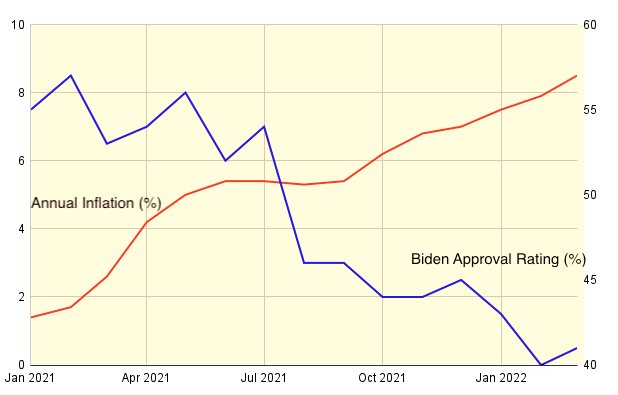

He Didn't Start the Fire By David G. Young Miami Beach, FL, April 19, 2022 -- Past American presidents have been fueling price inflation for 20 years. Our current president gets to suffer the consequences. As the rising price of ground beef nears $5 per pound1 and gasoline reaches $4 per gallon, other numbers are going down -- way down. President Joe Biden's approval rating has sagged to all time lows of about 40 percent.2 Compare this to last summer when more than half of Americans approved of his job performance. With so much else going well for America (low unemployment, strong economic growth, improved pandemic conditions), it is striking how much rising prices have soured the public mood. Last week, the Bureau of Labor Statistics confirmed something that supermarket shppers long suspected. Inflation of all items hit 8.5 percent relative to one year prior,3 the highest rate since President Ronald Reagan's first term in 1981.4

It's been so long since America faced such inflation that people under 60 have never experienced it as adults. But at 79, President Biden is most certainly old enough to remember. He started serving as a freshman Senator in 1973 as the Arab oil embargo triggered soaring inflation. A long period of inflation ranging from six to 12 percent would be a defining factor of the 1970s. Biden watched inflation ensure the downfall of presidents Nixon, Ford and Carter. No president would be re-elected until 1984 at which time inflation was finally under control. It's clearly unfair to blame President Biden for inflation just because it is happening on his watch. The fact is that Biden's three predecessors are far more to blame. Inflation is caused by expanding the money supply, and Presidents Bush, Obama and Trump did a stunning job of doing exactly that. Right at the start of the Bush era, a budget surplus quickly vanished and wars in Afghanistan and Iraq added $4.4 trillion5 to the national debt. As Bush's term ended, problems with subprime mortgages quickly spun into a full-fledged financial crisis. Obama's response to that crisis put $700 billion in stimulus on the nation's credit cards6 while the Federal Reserve began "quantitative easing" that printed $8 trillion in new US Dollars between 2009 and today.7 Under Presidents Trump and Biden, America spent yet another $3.6 trillion stimulating the economy in response to the Coronavirus pandemic.8 All of this $17 trillion expansion in the money supply was set in motion before Biden became president. But that doesn't mean he is free of guilt. As senator he voted for much of this spending including the wars in Iraq and Afghanistan. And as president, he led passage of a $1 trillion infrastructure bill, and tried to pass even more in social spending before that effort failed in the Senate. Given all this unconstrained deficit spending and money printing, the fact that we are seeing high inflation is hardly surprising. The real question is why did it take so long to happen? And why did all those other presidents manage get away with it? Part of the answer is that for all of the last two decades deflationary pressures counteracted money supply increases from deficit spending. An extraordinary shift in factory production to low-wage China during the 2000s held down costs for producing consumer goods and prevented inflation that would otherwise exist. That process was mostly complete by the time the financial crisis hit. But that same crisis sharply reduced consumer spending and created high unemployment. These factors held down prices for several more years. By 2020, when many economists were once again starting to scratch their heads about the surprising absence of inflation, the pandemic hit. This locked everybody up in their homes and suppressed both spending and inflation for another year and a half. All of those extraordinary conditions that kept inflation in check are now gone. Manufacturing that was once moved to East Asia is now moving the other direction. Unemployment that was once high is now very low. And consumers that were once cooped up by the pandemic are now unleashing themselves on the world in a huge spending spree. Provided that these conditions remain (and so much money from past government misdeeds remains sloshing around) inflation will be here to stay. That's bad news for President Biden and his Democratic allies in the House of Representatives. And while it may seem irrational for voters to punish Democrats for something that is at least equally the fault of Republicans, history shows that's just how politics works. Whoever is in office when something bad happens to the economy gets the blame. Just like many things in our new era of inflation, a Republican takeover of Congress is likely just another thing we'll need to learn to live with. Related Web Columns: Getting Away With It, October 19, 2019 Coming Drama, March 12, 2013 Living Like There's No Tomorrow, November 9, 2010 From America to Zimbabwe, March 24, 2009 Notes: 1. Budget-Conscious Shoppers Crossing Beef Off Grocery Lists as Prices Soar, March 10, 2022 2. Reuters, 53% of Americans Disapprove of the President, April 12, 2022 3. Bureau of Labor Statistics, Consumer Price Index Summary, April 12, 2022 4. Bureau of Labor Statistics, Consumer Prices up 8.5 Percent for Year Ended March 2022, April 18, 2022 5. Crawford, Neat C., United States Budgetary Costs and Obligations of Post-9/11 Wars through FY2020: $6.4 Trillion, November 13, 2019 6. The Balance, Obama's Stimulus Package and How Well It Worked, December 31, 2022 7. St. Louis Fed, Assets: Securities Held Outright: Securities Held Outright: Wednesday Level, April 14, 2022 8. USA Spending.gov, The Federal Response to COVID-19, February 28, 2022 |